New cost was basically shedding regarding the mortgage markets, so the top thing to do? And once you select what you need to do… how can you just do it?

It may be a perplexing situation, and most men and women have no idea how to make a choice. Allow me to walk you through the procedure so that you helps make the best possible a lot of time-term financial decision.

Financing Modifications

The first thing you have to know from the loan mod is because they is actually rare. Numerous finance companies you should never actually offer her or him. It is actually toward a lender by financial basis.

- Really does your bank promote mortgage loan modification?

An interesting most important factor of him or her, rather than refinancing the complete mortgage, youre staying the loan you curently have and only switching the interest rate and you may commission.

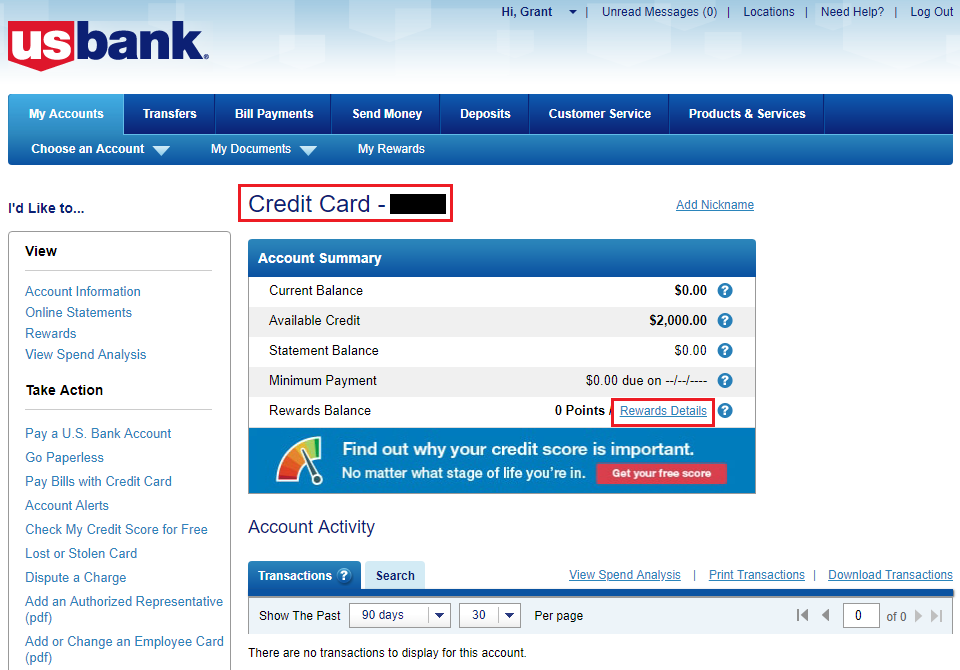

All you have to carry out are go into the bank you to definitely you work on (and you can exactly who gives the loan modifications) and ask for the current rate and you will spend a little percentage. By doing they that way, the loan amendment will save you several thousands of dollars to the refinancing.

If you decide to re-finance it can take your mortgage aside to a different 15 to 29-year label, while would purchase at the least four times normally currency since you did on a relatively simple amendment.

My partner, Taylor and i also recently performed financing amendment toward our home. We had been in a position to bring the speed down well over an excellent part, or step 1%. Changing your loan will cost you less than a complete re-finance.

Refinancing

You probably know how far the borrowed funds amendment cost you, but exactly how far wouldn’t it have been so you’re able to re-finance the mortgage?

The response to you to definitely question is advanced. A great deal depends on and therefore county your house is within the. There are lots of says having extremely expensive titlesother people was comparable to transformation taxation.

Such as for example, a house about east says have 1% x (and state our home is within can get tack with the various other 1% tax).

What if some body when you look at the an eastern state provides an excellent $five-hundred,000 financing. The fresh taxation are $10,100000, and the cost of new identity insurance coverage and appraisal. The individual normally refinance for about $fifteen,100.

Choosing Re-finance

This is exactly those types of unique lifetime products where in fact the factors on it therefore the answer are likely to vastly more to have all the resident.

- How much time am i going to are now living in this household?

- The amount loans Howard of money usually an excellent re-finance cut?

- Simply how much tend to a good re-finance rates?

- Will i break-even into the step 3.5 years?

Let’s say it appears as though you’ll not break-even up to of several years enjoys enacted? Which is while to issue out-of how much time you’ll are now living in our home.

- Are you presently just attending alive here for a few even more many years?

- Do you really believe it would be your own forever household?

The statistics show that people within their forever domestic will ultimately disperse once more, so it’s perhaps not indeed permanently. That also means you’ll not break even if you circulate.

Easily refinanced now, it might keeps pricing me more money, but I’d have been locked with the a killer rate.

But not, while i did financing amendment , I was hedging my bets. I happened to be in a position to down my personal interest rate, following in case the cost fell even further, I am able to however refinance having a far greater bargain (even when the $step 1,100000 allocated to the new amendment is lost).

Below are a few advice for the most recent prices at the time of the new prevent away from , and continue maintaining in your mind you to pricing vary each and every day: